Services We Offer

Our services are designed to streamline banking operations and improve efficiency by automating day to day tasks including account opening, transaction processing, and etc. Access of customer-related information in real-time helps your business serve customers better

Custom Banking Software Development

Our custom banking software development services provide everything from core banking systems to specialized modules that meet your business challenges.

Banking Application Development

Our banking application development team helps you create powerful, high-quality mobile and web applications which are needed to provide user experience.

Banking CRM Software Development

Improve your banking systems with scalability, security, and efficient banking solutions. Improve customer satisfaction and increase customer loyalty.

Core Banking System Development

Improvise your core banking solutions that are efficient and scalable. We help you to move from your traditional methods to modern technologies.

RBI Compliant Practices

All our development practices comply with RBI guidelines and regulations to ensure data security standards and risk management strategies.

What We Can Do For You?

As a leading banking application development company, working with different FinTech Industries to ensure security and fast transactions services which help them to grow. We develop high performing banking software solutions which adds value for our clients.

High End Security

We as a banking software developers, ensures to deliver a strong security suite which will help to meet your business needs and achieve your desirable outcome. Our measures like two-factor authentication, biometric help to protect the data from fraud.

Latest Tools and Technologies

We have a team of dedicated developers, they use the latest tools and advanced technology to deliver solutions with top-most security and scalability as your business demands for their growth.

Vendor Neutral Support

We as a banking development company focus on delivering new and high quality solutions which adhere to your business and industry requirements. We provide unbiased recommendations on which latest tech stack solutions you must opt for, to improve your business standards.

Innovative and Dedicated Team

Our team focuses on delivering unique and innovative solutions for banking sector industries. We have a dedicated team to provide the solutions before the deadlines and monitor it, so that it updates as your business grows.

Strong Research and Development

Our company’s motive is to deliver the solution which fits your expectations. With a strong research and analyses team we analyse your business and develop the solutions as per the analyses to support your business demands.

Our Numbers Speak for Themselves

With excellence in providing cutting-edge solutions for business growth and success across the world!

Industry Sectors We Serve For

Digital Banking

- Custom banking softwares with integration

- Advance Fraud Detection Systems

- Secure mobile and banking applications

Fintech

- Data Analytics Platform for financial insights

- Payment processing solutions with fast transactions

- AI-based financial platform ensures security

E-Commerce

- Advanced payment gateway integrations

- Scalable ecommerce platform

- Inventory management systems with real time monitoring

Lending and Payments

- Digital payments system

- Automated loan and approval systems

- Real-time payment processing with security measures

Investment Management

- Portfolio management systems

- Risk management tools and services

- Real time market analysis

Our Process for Banking Software Development

How We Help Your Business

Requirement Analysis

Collecting your banking data and requirements to implement your software solutions. We analyse the system and workflow to provide the custom software solutions.

JIRA

Confluence

User Story Mapping Tools (e.g., Miro, StoriesOnBoard)

Designing and Planning

Our team designs a prototype that meets your business expectations and ensures security that implements with financial systems enables future growth of the platform.

JIRA

Confluence

User Story Mapping Tools (e.g., Miro, StoriesOnBoard)

Development and Implementation Phase

Our experts build the solutions using the latest technology and secure coding standards. We take proper feedback to adhere to your business requirements until the development process gets completed.

JIRA

Confluence

User Story Mapping Tools (e.g., Miro, StoriesOnBoard)

Testing and Deployment

We provide the testing assistance to check the security and performance of systems and then deploy the banking software solutions to integrate with the existing models and third party services.

JIRA

Confluence

User Story Mapping Tools (e.g., Miro, StoriesOnBoard)

Maintenance and Support

We provide maintenance and support for your banking software to check the scalability and security measures. We ensure the automation of repeated tasks and continuous monitoring.

JIRA

Confluence

User Story Mapping Tools (e.g., Miro, StoriesOnBoard)

Our Client’s Success Stories

As a recognised banking software development company, we empowered startups and financial institutions to regain their digital banking goals.

Best Banking Software Development Company

Case Studies

Our clients get the advantage of the power of banking technologies to optimize the operations, and security to enhance the overall growth.

Case Study 1: Rezcomm

Cut down the AWS cost by 30%, and boosted performance to get PCI compliance and featured deployment by 40% using Terraform and AI technologies.

Case Study 2: Staffing Future

Got 40% faster transactions and reduced cost by 25%. Managed 30% higher user satisfaction, improved data management and security.

Case Study 3: iQ Credit Union

Reduced the cost estimation by 40% and improved the performance by 30% with team effort and innovative global talent.

Digital Transformation for The Credit Pros

The Credit Pros is a leading credit repair company based in the United States. Founded with the mission to assist clients in improving their credit scores, The Credit Pros offers a range of services including credit repair, credit monitoring, and financial education. Their goal is to empower individuals to achieve financial freedom through enhanced creditworthiness and better financial management.

Maximizing Efficiency with Proper Technology Implementation – Rezcomm

Rezcomm is a leading provider of e-commerce, marketing, and business intelligence solutions for airports, venues, and destinations worldwide. Their comprehensive platform enables clients to enhance customer experiences, streamline operations, and drive revenue growth through advanced technology solutions.

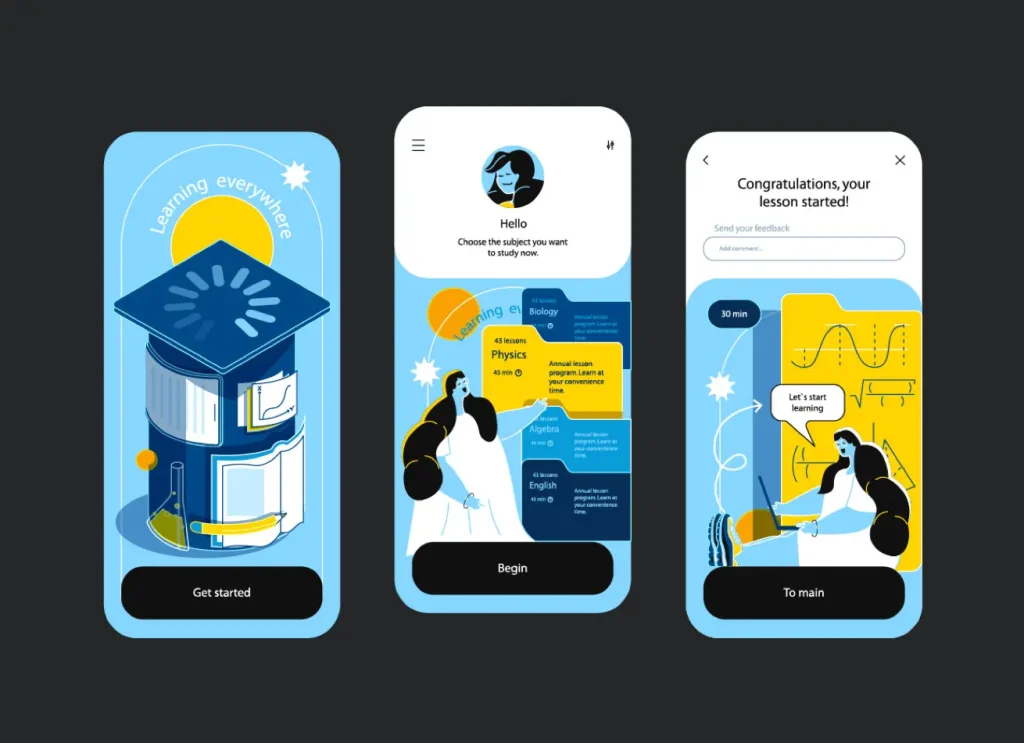

Building an Online Platform for Distance Learning

Coursera is a leading online learning platform offering a vast array of courses, specializations, and degrees from top universities and companies globally. The platform aims to make education accessible, affordable, and engaging for learners worldwide, providing opportunities to acquire new skills and advance their careers through flexible, online learning.

Tech Stacks

Python

Big Data

Machine Learning

ETL

Databricks

Pandas

Sci-kit learn

Tableau

Tensorflow

Grafana

Azure

Oracle

DevOps

AWS

FAQs

What banking development services do we offer?

We offer different banking software services like core banking solutions, mobile and online banking applications, and payment processing platforms. These solutions help automate the business processes.

How do our solutions ensure security and compliance?

Our banking solution system integrates with multiple layers of security like two-factor authentication, and encryption for real-time fraud detection. All solutions are built to adhere to banking regulations like GDPR, KYC, and financial regulations.

Do you provide the ongoing support and maintenance?

Yes, we offer support and maintenance, regular security updates, and performance optimization. Our dedicated team have expertise in the latest banking technologies which look after your systems.

What technologies do you use for banking software development?

We use modern techniques like cloud based architecture, DevOps, and latest technology like Python, Azure and AWS. We provide help to implement AI/ML for risk management and fraud detection.

What Industries are benefited from banking software solutions?

Banking software solutions benefit the financial institutes like startups, insurance, payment and lending services. These systems are built to improve customer satisfaction and enhance security.